UCO Bank’s former CMD amassed 100 crores by helping a corrupt industrialist get loans worth 6200 crores through shell companies: How ED busted the scam

The Enforcement Directorate (ED) discovered an extensive banking fraud of over Rs 6,200 crore, which took place under the Congress rule. As per reports, Sanjay Sureka, a businessman from Kolkata, devised and executed the scam by setting up a network of 60 fictitious shell firms. These companies had no actual operations, but they displayed bogus business activity on paper. The industrialist was arrested by the agency on 17th December 2024. Sureka used drivers, housekeepers, office boys, junior employees and family members as directors, and created a fraudulent turnover of thousands of crores in iron and steel manufacturing. He leveraged these faux businesses to build an image of a rapidly expanding enterprise with enormous revenue. With the head of one of the major banks acting as an accessory, he defrauded a consortium of PSU (Public Sector Undertaking) banks of an astounding amount. Sureka obtained the loans with the assistance of Subodh Kumar Goel, the then Chairman and Managing Director (CMD) of UCO Bank, formerly known as United Commercial Bank, between 2007 and 2010, during Congress-led UPA’s (United Progressive Alliance) regime. The ED’s inquiry report found out, “Against loans of over Rs 6,200 crore, the company’s liquidation value barely reached Rs 600 crore, and assets sold so far have realised only Rs 434 crore,” reported The Times of India. “It is a case study in how an entire financial ecosystem can be manipulated through fake turnover, circular transactions and system-wide blind spots, ultimately leaving public sector banks poorer by more than Rs 6,210.7 crore, excluding interest,” expressed a senior official quoted by TOI. ED raids Sureka’s properties, nabs him under PMLA The staggering scam came to light as Sureka was nabbed following widespread raids in 13 places connected to him in Kolkata in December 2024. His firms, including Concast Steel and Power Group and his house in Ballygunge, where multiple expensive cars and jewels priced at Rs 4.5 crore were confiscated. The Central Bureau of Investigation (CBI) submitted an FIR (First Information Report), which prompted ED to start money-laundering proceedings. An official statement read, “The group had availed a credit facility from 11 Public Sector Banks and five financial institutions, having a total default of Rs 6210 crore as the company turned into NPA (Non-Performing Asset) on 30.9.2016. ED initiated an investigation per an FIR registered by CBI, BSFB (Banking Securities Fraud Branch), Kolkata, under various sections of IPC (Indian Penal Code) and Prevention of Corruption Act against Sanjay Sureka & others on the basis of a complaint filed by the SBI (State Bank of India), the lead bank of the consortium.” For more than a year, the ED had been maintaining an eye on Sureka’s involvement in the fraud. He was unable to give appropriate responses when questioned about the misappropriation of funds and the confiscated jewellery. Furthermore, he could not provide legitimate documentation for the expensive items inside his home. The Calcutta High Court also denied his request for bail last November and affirmed that information alone can support a Prevention of Money Laundering Act (PMLA) arrest. ED had already attached real estate assessed at Rs. 210.07 crore in February 2025, under the act. It was determined that Sureka advantageously controlled these possessions, which included homes, offices, commercial stores and plots. Inception of an extraordinary con Concast Steel & Power Limited (CSPL), a once prominent steel company of Kolkata, was at the root of the fraud. It had units in Andhra Pradesh, Odisha and West Bengal, for the production of mild steel, sponge iron, pig iron, and rolled goods, including TMT (Thermo-Mechanically Treated) bars, angles, channels, and ferro alloys. Sureka acquired control of the business in 2008 and gradually began to form the network of counterfeit entities. According to the ED, the funds were obtained without the required checks, interest, or penalties and in exchange. The then UCO Bank CMD SK Goel received benefits through shell corporations that purchased properties on his behalf and subsequently gave his family members ownership. The probe disclosed that CSPL displayed fabricated acquisitions, sales and conveyance of products. No products were transported, but false truck receipts and bills were generated. There was no actual money transferred through banks in about 99 per cent of sales and payments, which were merely book entries. Officials with insight into the case unveiled, “This meant Concast was essentially selling to itself and then realising these payments through accounting fiction. By 2017, the deception hit its peak, 99% of all sales to these entities were settled through book adjustments, not a single real rupee flowed in through the banking system.” The investigation outlined that CSPL produced fake invoices, ledger entries, and transport papers to s

The Enforcement Directorate (ED) discovered an extensive banking fraud of over Rs 6,200 crore, which took place under the Congress rule. As per reports, Sanjay Sureka, a businessman from Kolkata, devised and executed the scam by setting up a network of 60 fictitious shell firms. These companies had no actual operations, but they displayed bogus business activity on paper. The industrialist was arrested by the agency on 17th December 2024.

Sureka used drivers, housekeepers, office boys, junior employees and family members as directors, and created a fraudulent turnover of thousands of crores in iron and steel manufacturing. He leveraged these faux businesses to build an image of a rapidly expanding enterprise with enormous revenue. With the head of one of the major banks acting as an accessory, he defrauded a consortium of PSU (Public Sector Undertaking) banks of an astounding amount.

Sureka obtained the loans with the assistance of Subodh Kumar Goel, the then Chairman and Managing Director (CMD) of UCO Bank, formerly known as United Commercial Bank, between 2007 and 2010, during Congress-led UPA’s (United Progressive Alliance) regime. The ED’s inquiry report found out, “Against loans of over Rs 6,200 crore, the company’s liquidation value barely reached Rs 600 crore, and assets sold so far have realised only Rs 434 crore,” reported The Times of India.

“It is a case study in how an entire financial ecosystem can be manipulated through fake turnover, circular transactions and system-wide blind spots, ultimately leaving public sector banks poorer by more than Rs 6,210.7 crore, excluding interest,” expressed a senior official quoted by TOI.

ED raids Sureka’s properties, nabs him under PMLA

The staggering scam came to light as Sureka was nabbed following widespread raids in 13 places connected to him in Kolkata in December 2024. His firms, including Concast Steel and Power Group and his house in Ballygunge, where multiple expensive cars and jewels priced at Rs 4.5 crore were confiscated. The Central Bureau of Investigation (CBI) submitted an FIR (First Information Report), which prompted ED to start money-laundering proceedings.

An official statement read, “The group had availed a credit facility from 11 Public Sector Banks and five financial institutions, having a total default of Rs 6210 crore as the company turned into NPA (Non-Performing Asset) on 30.9.2016. ED initiated an investigation per an FIR registered by CBI, BSFB (Banking Securities Fraud Branch), Kolkata, under various sections of IPC (Indian Penal Code) and Prevention of Corruption Act against Sanjay Sureka & others on the basis of a complaint filed by the SBI (State Bank of India), the lead bank of the consortium.”

For more than a year, the ED had been maintaining an eye on Sureka’s involvement in the fraud. He was unable to give appropriate responses when questioned about the misappropriation of funds and the confiscated jewellery. Furthermore, he could not provide legitimate documentation for the expensive items inside his home. The Calcutta High Court also denied his request for bail last November and affirmed that information alone can support a Prevention of Money Laundering Act (PMLA) arrest.

ED had already attached real estate assessed at Rs. 210.07 crore in February 2025, under the act. It was determined that Sureka advantageously controlled these possessions, which included homes, offices, commercial stores and plots.

Inception of an extraordinary con

Concast Steel & Power Limited (CSPL), a once prominent steel company of Kolkata, was at the root of the fraud. It had units in Andhra Pradesh, Odisha and West Bengal, for the production of mild steel, sponge iron, pig iron, and rolled goods, including TMT (Thermo-Mechanically Treated) bars, angles, channels, and ferro alloys. Sureka acquired control of the business in 2008 and gradually began to form the network of counterfeit entities.

According to the ED, the funds were obtained without the required checks, interest, or penalties and in exchange. The then UCO Bank CMD SK Goel received benefits through shell corporations that purchased properties on his behalf and subsequently gave his family members ownership.

The probe disclosed that CSPL displayed fabricated acquisitions, sales and conveyance of products. No products were transported, but false truck receipts and bills were generated. There was no actual money transferred through banks in about 99 per cent of sales and payments, which were merely book entries.

Officials with insight into the case unveiled, “This meant Concast was essentially selling to itself and then realising these payments through accounting fiction. By 2017, the deception hit its peak, 99% of all sales to these entities were settled through book adjustments, not a single real rupee flowed in through the banking system.”

The investigation outlined that CSPL produced fake invoices, ledger entries, and transport papers to support its nonexistent purchases and sales of iron and steel items with affiliated companies.

A source mentioned, “Fake transportation receipts were prepared to show trucks carrying goods between factories and shell companies, even though no truck ever moved, no goods were loaded, and no delivery was made. Yet on paper, CSPL looked like a bustling, high-volume operation with continuous production and sales.”

The same network of connected corporations supplied more than half of all raw materials. However, the report unearthed that about 90% of payments to them were created through internal modifications, similar to sales. There was no actual cash outflow or material movement, while only regular entries were made to inflate working capital requirements, legitimise large fund withdrawals and manufacture expenses.

Meanwhile, banks continued to lend money amid years of deceptive conduct. Rs 434 crore has been recovered thus far from CSPL’s assets, which were only worth about Rs 600 crore when it failed. On the other hand, public banks continued to pour thousands of crores and no red flags were ever raised.

ED arrests partner-in-crime and other key accused

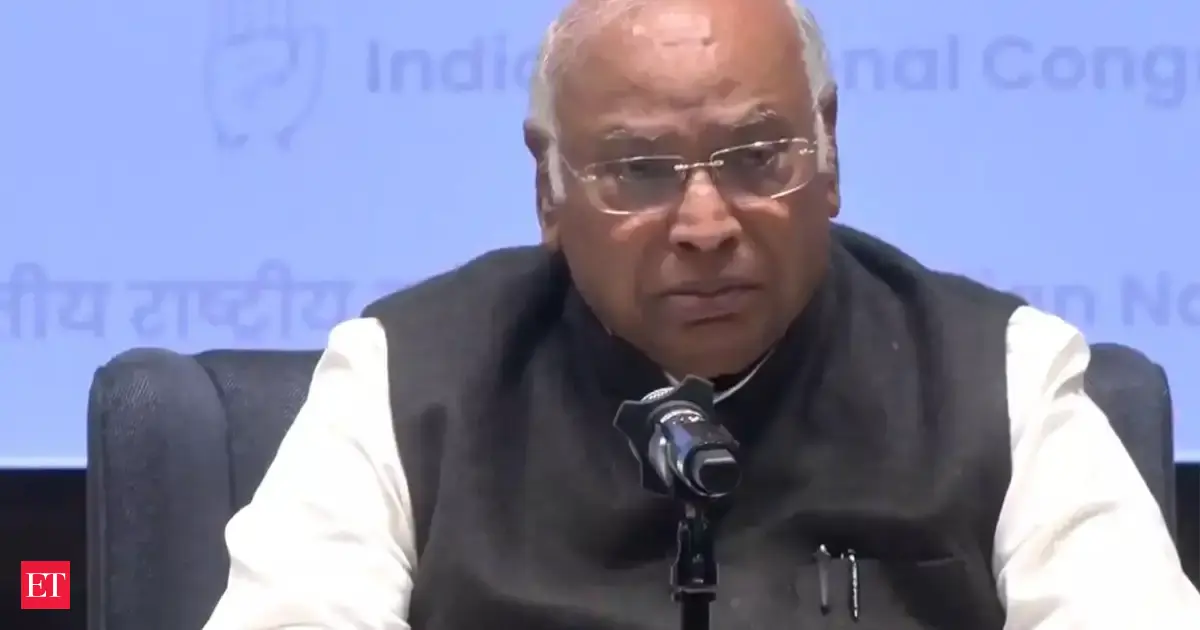

The agency apprehended former UCO Bank CMD SK Goel on 16th May of last year, and attached the properties connected to his family and acquaintances that are valued at more than Rs 106.36 crore. ED had searched his premises as well as those belonging to others in relation to the investigation.

Goel was taken into custody at his New Delhi home and brought before the special PMLA court in Kolkata on 17th May. He was placed under ED custody until 21st May. Large loan facilities that were “sanctioned” under Goel’s authority were “diverted” and “syphoned off” by the borrower group as he gained “substantial illegal gratification” for his unlawful services.

“The illegal gratification was layered and channelled through various entities to give a facade of legitimacy. Investigation revealed that Goel received cash, immovable properties, luxury goods, hotel bookings, etc, routed through a web of shell companies, dummy persons, and through family members to conceal the criminal origin of the money,” the agency highlighted.

Kolkata, West Bengal: ED arrests former UCO Bank CMD Subodh Kumar Goel in ₹12,000 crore bank fraud case. He was brought from Delhi on transit remand and will be produced before the Bankshall Court today pic.twitter.com/wadaLBdCfS

— IANS (@ians_india) May 17, 2025

According to the findings, a number of properties obtained through phoney or fake businesses have been identified, “beneficially owned or controlled” by Goel and his family members. “The source of funds of these entities is linked to CSPL. Evidence gathered so far also shows use of accommodation entries and structured layering through front companies for systematic settlement of kickbacks,” ED added. Goel had approached a Kolkata sessions court for bail, but the petition was rejected.

Anant Kumar Agarwal, a chartered accountant (CA) from Kolkata, was also captured by the ED in July on allegations of helping Goel launder money. The agency highlighted that the former actively founded and supervised a network of pseudo companies. These served to pass off illegal proceeds as legitimate financial transactions, including share capital routed for cash and spurious unsecured loans.

The ED revealed that Agarwal held important roles in organisations directly involved in money laundering operations. He also offered his expert aid to conceal the money trail. Under the pretence of genuine business entries, the firms were used to layer and reroute the dirty money, frequently bringing it into legal accounting accounts.

The agency had declared, “Properties worth Rs 612.71 crore have been provisionally attached till date. The key accused persons, namely Sanjay Sureka, Subodh Kumar Goel and Anant Kumar Agarwal remain in judicial custody,” on 25th July.