Fastest growing economy, robust exports, expanding service sector and more: Economic Survey 26 highlights India’s impressive growth story amid global challenges and US tariffs

On 29th January (Thursday), Union Finance Minister Nirmala Sitharaman presented the Economic Survey 2025-26 to Parliament. For the fourth year in a row, it confirmed the country‚Äôs status as the fastest-growing major economy. According to the report, India‚Äôs economy is set to grow between 6.8% and 7.2% in the fiscal year 2026-27. Prime Minister Narendra Modi also reacted to the key findings and remarked, ‚ÄúThe Economic Survey tabled today presents a comprehensive picture of India‚Äôs Reform Express, reflecting steady progress in a challenging global environment. It highlights strong macroeconomic fundamentals, sustained growth momentum and the expanding role of innovation, entrepreneurship and infrastructure in nation-building.‚Äù He mentioned that the survey emphasises the significance of inclusive development, devoting particular attention to MSMEs (Micro, Small, and Medium Enterprises), farmers, youth employment and social welfare. ‚ÄúIt also outlines the roadmap for strengthening manufacturing, enhancing productivity and accelerating our march towards becoming a Viksit Bharat. The insights offered will guide informed policymaking and reinforce confidence in India‚Äôs economic future,‚Äù PM Modi shared. The Economic Survey tabled today presents a comprehensive picture of India‚Äôs Reform Express, reflecting steady progress in a challenging global environment. It highlights strong macroeconomic fundamentals, sustained growth momentum and the expanding role of innovation,‚Ķ https://t.co/ih9ArrtZcU‚Äî Narendra Modi (@narendramodi) January 29, 2026 This is in line with the International Monetary Fund‚Äôs (IMF) outlook which recently increased the country‚Äôs growth estimate for 2025-26 to 7.3% up 0.7 percentage points from its October projection of 6.2%. Additionally, the IMF raised its 2026‚Äì2027 assessment from 6.2% to 6.4%. The survey observed that India‚Äôs economy has remained stable amidst global unpredictability. It pointed out that trade interruptions, especially those brought on by tariffs and slower development in important international markets might have an impact on exports and investor confidence. India has consistently registered incredible GDP numbers overtaking forecasts. India‚Äôs continuous growth despite US tariffs India‚Äôs overall exports (merchandise and services) hit a record $825.3 billion in FY25 and continued to grow in FY (Fiscal Year) 26 amid the uncertainty surrounding global trade. According to the survey, merchandise exports rose by 2.4% (April‚ÄìDecember 2025) while services exports surged by 6.5% despite the¬Ýhiked tariffs. The government has set growth for the current fiscal year at 7.4% which is higher than the 6.3-6.8% range predicted in the analysis from the previous year. The survey outlined that the development accelerated despite the significant tariff hikes. It read, ‚ÄúAlthough growth estimates were reduced after the US imposed a combined 50 per cent tariff on several Indian exports in 2025, actual performance exceeded expectations.‚Äù Trump‚Äôs decision to penalise the Modi government for refusing to nominate him for the Nobel Peace Prize and countering his claims of mediation between New Delhi and Islamabad seems to have failed to halt India‚Äôs growth trajectory. The provisional accounts informed that India‚Äôs budget deficit decreased from 9.2% of GDP (Gross Domestic Product) in FY21 to 4.8% in FY25 and will likely¬Ýreach 4.4% in FY26. The revenue shortfall as a share of GDP has continuously reduced, reaching its lowest level since FY09. The quality of government spending has improved as a result of higher funds available for capital expenditures. According to the First Advance Estimates, real GDP growth in India is believed to be 7.4% in FY26, demonstrating the country‚Äôs sustained strong development pace. The survey conveyed, ‚ÄúPrivate consumption and capital formation continue to support expansion, while services remain the key contributor on the supply side. Manufacturing activity has strengthened, and agriculture has provided stability, notwithstanding structural constraints.‚Äù Fiscal indicators have also improved with the centre‚Äôs income receipts jumping to 9.2% of GDP in FY25. Three international organisations upgraded India‚Äôs sovereign credit rating in 2025 as a result of its meticulous fiscal management. In September 2025, Gross Non-Performing Assets (GNPA) fell to a multi-decadal low of 2.2%, reflecting an outstanding improvement in asset quality in the banking industry. As of December 2025, credit growth was 14.5% signalling strong momentum in lending activity. Meanwhile, India‚Äôs external debt went up from USD 736.3 billion at the end of March 2025 to USD 746 billion at the end of September 2025. The country‚Äôs external debt to GDP ratio was 19.2%. Moreover, under five per cent of its overall debt is external, which reduces the risks associated with the external sector. India‚Äôs comparatively minor contribution to global indebtedness is shown by the fact

On 29th January (Thursday), Union Finance Minister Nirmala Sitharaman presented the Economic Survey 2025-26 to Parliament. For the fourth year in a row, it confirmed the country’s status as the fastest-growing major economy. According to the report, India’s economy is set to grow between 6.8% and 7.2% in the fiscal year 2026-27.

Prime Minister Narendra Modi also reacted to the key findings and remarked, “The Economic Survey tabled today presents a comprehensive picture of India’s Reform Express, reflecting steady progress in a challenging global environment. It highlights strong macroeconomic fundamentals, sustained growth momentum and the expanding role of innovation, entrepreneurship and infrastructure in nation-building.”

He mentioned that the survey emphasises the significance of inclusive development, devoting particular attention to MSMEs (Micro, Small, and Medium Enterprises), farmers, youth employment and social welfare. “It also outlines the roadmap for strengthening manufacturing, enhancing productivity and accelerating our march towards becoming a Viksit Bharat. The insights offered will guide informed policymaking and reinforce confidence in India’s economic future,” PM Modi shared.

The Economic Survey tabled today presents a comprehensive picture of India’s Reform Express, reflecting steady progress in a challenging global environment.

— Narendra Modi (@narendramodi) January 29, 2026

It highlights strong macroeconomic fundamentals, sustained growth momentum and the expanding role of innovation,… https://t.co/ih9ArrtZcU

This is in line with the International Monetary Fund’s (IMF) outlook which recently increased the country’s growth estimate for 2025-26 to 7.3% up 0.7 percentage points from its October projection of 6.2%. Additionally, the IMF raised its 2026–2027 assessment from 6.2% to 6.4%.

The survey observed that India’s economy has remained stable amidst global unpredictability. It pointed out that trade interruptions, especially those brought on by tariffs and slower development in important international markets might have an impact on exports and investor confidence. India has consistently registered incredible GDP numbers overtaking forecasts.

India’s continuous growth despite US tariffs

India‚Äôs overall exports (merchandise and services) hit a record $825.3 billion in FY25 and continued to grow in FY (Fiscal Year) 26 amid the uncertainty surrounding global trade. According to the survey, merchandise exports rose by 2.4% (April‚ÄìDecember 2025) while services exports surged by 6.5% despite the¬Ýhiked tariffs.

The government has set growth for the current fiscal year at 7.4% which is higher than the 6.3-6.8% range predicted in the analysis from the previous year. The survey outlined that the development accelerated despite the significant tariff hikes. It read, “Although growth estimates were reduced after the US imposed a combined 50 per cent tariff on several Indian exports in 2025, actual performance exceeded expectations.”

Trump’s decision to penalise the Modi government for refusing to nominate him for the Nobel Peace Prize and countering his claims of mediation between New Delhi and Islamabad seems to have failed to halt India’s growth trajectory.

The provisional accounts informed that India‚Äôs budget deficit decreased from 9.2% of GDP (Gross Domestic Product) in FY21 to 4.8% in FY25 and will likely¬Ýreach 4.4% in FY26. The revenue shortfall as a share of GDP has continuously reduced, reaching its lowest level since FY09. The quality of government spending has improved as a result of higher funds available for capital expenditures.

According to the First Advance Estimates, real GDP growth in India is believed to be 7.4% in FY26, demonstrating the country’s sustained strong development pace. The survey conveyed, “Private consumption and capital formation continue to support expansion, while services remain the key contributor on the supply side. Manufacturing activity has strengthened, and agriculture has provided stability, notwithstanding structural constraints.”

Fiscal indicators have also improved with the centre’s income receipts jumping to 9.2% of GDP in FY25. Three international organisations upgraded India’s sovereign credit rating in 2025 as a result of its meticulous fiscal management. In September 2025, Gross Non-Performing Assets (GNPA) fell to a multi-decadal low of 2.2%, reflecting an outstanding improvement in asset quality in the banking industry. As of December 2025, credit growth was 14.5% signalling strong momentum in lending activity.

Meanwhile, India’s external debt went up from USD 736.3 billion at the end of March 2025 to USD 746 billion at the end of September 2025. The country’s external debt to GDP ratio was 19.2%. Moreover, under five per cent of its overall debt is external, which reduces the risks associated with the external sector. India’s comparatively minor contribution to global indebtedness is shown by the fact that, as of December 2024, it only makes up 0.69 per cent of the world’s external debt.

Strong export numbers, an increase in foreign reserves, controlled inflation and more

Despite increasing US tariffs, India‚Äôs product exports climbed 2.4 per cent during April-December 2025, while exports of services jumped 6.5 per cent. Goods and services combined, total exports touched a record $825.3 billion in FY25 and have proceeded to improve¬Ýin FY26.

During the same time period, there was a 5.9% increase in merchandise imports, however, this was countered by a greater services trade surplus and strong remittances. As a result, in H1 (First Half) FY26, the current account deficit stayed low at 0.8% of GDP.

India‚Äôs foreign exchange reserves also grew from USD 668 billion at the end of March 2025 to USD 701.4 billion as of 16th¬ÝJanuary. The reserves are adequate to service approximately 94% of the outstanding external debt at the end of September 2025 and roughly 11 months of worth of goods imports, offering a comfortable liquidity buffer.

The central government did not allow the erratic global markets and unprecedented shifts to negatively affect the wallets of consumers within the country, adding further to this achievement. According to the survey, India’s average headline inflation rate from April to December 2025 was 1.7%, the lowest since the start of the CPI (Consumer Price Index) series.

India saw one of the biggest drops in headline inflation in 2025, roughly 1.8 percentage points, among the major Emerging Markets & Developing Economies (EMDEs). Significantly, this disinflation coincided with solid GDP growth of 8% in the first half of FY 2026, highlighting India’s sound macroeconomic foundations and capacity to maintain growth while skilfully controlling pricing pressures without overheating.

The survey also pointed out that India‚Äôs services sector has become a stabilising factor, providing more than half of the nation‚Äôs Gross Value Added (GVA) and acting as a major driver of employment and exports. According to First Advance Estimates (FAE) of FY26, its¬Ýpercentage of GDP surged to 53.6% in H1 FY26 and¬Ýits share of GVA stood at the highest level ever at¬Ý56.4%. This indicated the expanding importance¬Ýof modern, tradable¬Ýand digitally supplied services.

India’s share in global services trade more than doubled from 2% in 2005 to 4.3% in 2024, making it the seventh-largest exporter of services worldwide. It is the nation’s main development engine and accounts for more than half of the country’s GDP. The sector grew 9.1 per cent in FY 2025-2026, propelling total growth while the rise of services exports surged from 7-8 per cent before the pandemic to almost 14 per cent in recent years.

With an average of 80.2% of all FDI during FY23–FY25, up from 77.7% during the pre-pandemic period (FY16–FY20), the services sector remained the biggest receiver of FDI inflows. Notably, the industry has grown by an average of 7-8% on an annual basis.

India similarly reinforced its role as a worldwide leader in greenfield digital investment and has been placed fourth in the world for greenfield investment announcements in 2024 with more than 1,000 projects. From 2020 to 2024, it became the most popular location for greenfield digital investments in the world, drawing USD 114 billion.

The domestic economy “is one of steady growth amid global uncertainty, requiring caution, but not pessimism,” according to the survey, which also asserted that a significant infrastructure investment is necessary for India’s economic objectives over the next ten years. India is indeed confronted with various difficulties that it must overcome to realise its future ambitions; however, it illustrated that the nation is on a positive course.

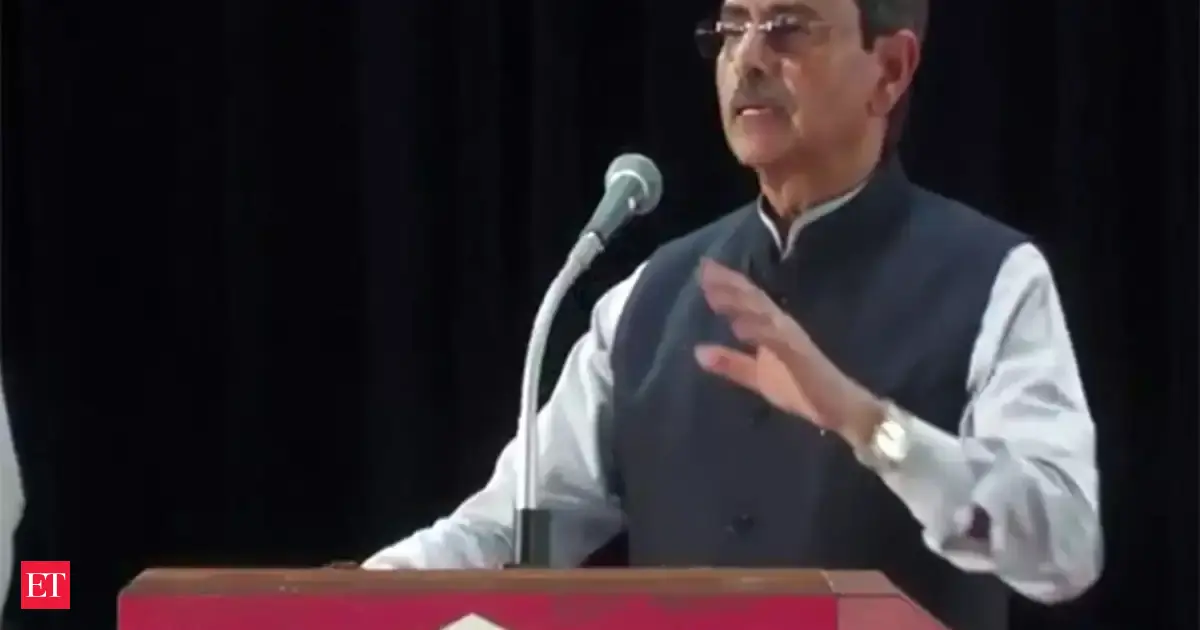

Several cabinet ministers praised the survey, including Home Minister Amit Shah, who declared that it “attests to the might the Indian economy has acquired under the visionary leadership of PM Modi, forging ahead vigorously, tossing challenges aside.”

The Economic Survey 2025-26 attests to the might the Indian economy has acquired under the visionary leadership of PM Shri @narendramodi Ji, forging ahead vigorously, tossing challenges aside.

— Amit Shah (@AmitShah) January 29, 2026

When the world plunged from the pandemic to economic instability, our economy sailed… pic.twitter.com/gcZw4DdIvD

The minister interestingly articulated the result of the survey in precise terms and added, “When the world plunged from the pandemic to economic instability, our economy sailed ahead smoothly over both the hurdles with everyone on board, thanks to our leadership.”